How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110010, by SLA Consultants India, New Delhi,

GSTR-2B plays a pivotal role in helping businesses claim Input Tax Credit (ITC) accurately and efficiently under India’s GST regime. As a static, auto-drafted statement generated monthly on the GST portal, GSTR-2B provides taxpayers with a clear, document-wise summary of eligible and ineligible ITC based on the invoices, debit/credit notes, and returns filed by suppliers in GSTR-1, GSTR-5, and GSTR-6. Unlike the dynamic GSTR-2A, GSTR-2B remains unchanged for a given period, offering a stable reference point for reconciliation and eliminating the confusion caused by late supplier filings or amendments.

This stability is crucial for businesses, as the ITC available for claim in GSTR-2B cannot be exceeded in a tax period. Taxpayers must reconcile their purchase register and other records with GSTR-2B before filing GSTR-3B, ensuring that only eligible ITC is claimed and ineligible credits are reversed as required by GST law. The summary in GSTR-2B clearly distinguishes between ITC that can be availed and that which must be reversed, guiding businesses toward compliant and error-free tax filings.

GSTR-2B’s document-level details—covering invoices, credit/debit notes, and amendments—enable thorough verification and help identify mismatches early. This not only reduces the risk of claiming ineligible credits but also minimizes the chances of notices or penalties from tax authorities due to discrepancies. By providing a consistent, structured overview of ITC, GSTR-2B simplifies monthly GST reconciliation and enhances the accuracy of ITC claims, supporting better cash flow and compliance for businesses.

Moreover, the introduction of GSTR-2B has streamlined the entire ITC claim process, making it easier for businesses to match their claims with supplier filings and avoid common errors that previously led to blocked credits or disputes. Advanced GST software tools now automate much of the reconciliation process, further reducing manual effort and improving the reliability of ITC claims. GST Certification Course in Delhi

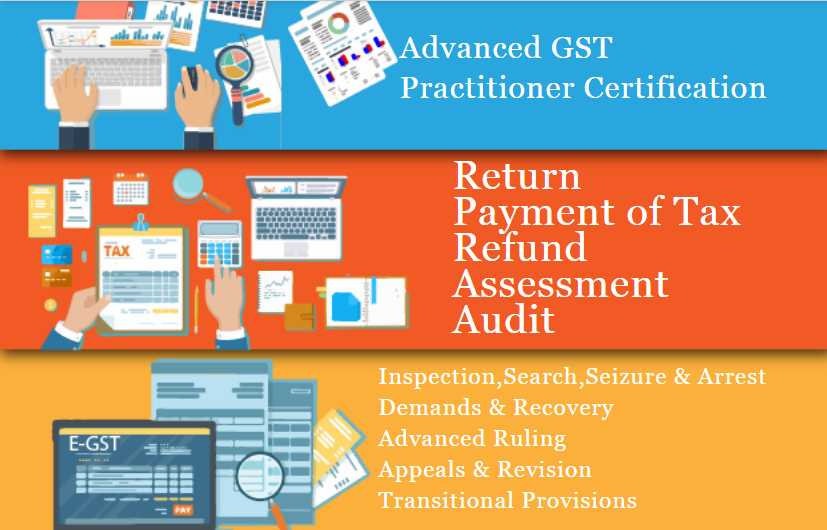

For those seeking hands-on expertise in ITC management and GST compliance, the Practical GST Course in Delhi (110010) by SLA Consultants India provides in-depth training on GSTR-2B, reconciliation, and all aspects of GST return filing. This practical approach ensures professionals and business owners can maximize ITC benefits while maintaining full compliance in today’s evolving GST landscape.

SLA Consultants How GSTR-2B Helps in Claiming ITC Correctly, Get Practical GST Course in Delhi, 110010, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/